During the years 2020 and 2021, we experienced global ups and downs like never before. The stock markets took a dive and many businesses are still recovering from unexpected losses and closures. In these uncertain times, every investor needs a solution to maintain their portfolio.

Real estate investments are still one of the most profitable ways to build wealth. Everyone needs a place to call home even during economic downturns. In this guide, we will discuss some of the most durable and profitable residential real estate investments available.

Where to Invest 500k in Real Estate

Getting started in real estate investing can be done for much less than you might think. But what if you have a nest egg of around 500k? This can be a game-changer for your investment strategy. We recommend investing in residential or commercial real estate if you really want to use your 500k wisely.

In this post, we will cover the most profitable investments in residential real estate, so you can invest wisely and ensure your nest egg grows exponentially. Commercial real estate, such as self-storage buildings, warehouses, and office buildings, is also a brilliant way to build wealth.

Passive Income vs Appreciation

The main difference between passive income investing and appreciation is how you receive a return. Appreciation is when you buy a residential property and hold on to it for a certain amount of time before selling it again to make a profit. You might pursue this strategy because you may have reason to believe that home values in the area will increase over time, in which case you might want to flip the house to make a profit.

Passive income, on the other hand, is when your property makes money for you by providing rental income. It is one of the best and most versatile ways to make your money work for you. We recommend choosing a passive income strategy when investing in residential real estate if you want to focus on living your life while earning money at the same time.

Best Residential Real Estate Investments

Single-Family Homes

One of the simplest and most effective ways to invest in real estate is to buy a single-family home outright. With 500k, you can purchase the house in cash and rent it out for as long as you want. You could actually purchase multiple single-family homes with your initial investment amount.

Single-family homes are profitable since you are often dealing with long-term tenants and families. They often take care of the property better than short-term tenants. They might even want to make repairs or renovations, which can increase the value of the home. If you properly vet your tenants and make good choices, you will receive monthly income that goes straight into your pocket and you won’t have to worry about your mortgage repayments.

Multi-Family Units

Multi-family buildings typically have up to five residential units and resemble a small house or apartment. They are often called duplexes or triplexes. One benefit to this investment strategy is that you can live in one unit, rent out others, and earn a passive income. Multi-family units require more management than a single-family home but less management than an apartment complex.

With an initial investment of 500k, you can make a good down payment on a multi-family property or even buy it in cash. This can increase your monthly passive income immensely by reducing your need to take out a mortgage. This type of investment can be profitable even in times of economic downturn.

Apartment Buildings

With a 500k investment, buying an apartment complex is a great way to maximize your passive income earning potential. You can invest in a small apartment building with less than 50 units by making a down payment and leveraging the rest. The more units in the building, the more passive income you can make.

However, you may need to hire a property manager who can handle tenant requests, maintenance requests, parking, and rent collection with large buildings. Before deciding to invest in a rental property, remember to do your due diligence and ensure the property is right for you.

Real Estate Investment Trusts (REITs)

If you are interested in investing in residential properties, then a real estate investment trust (REIT) is a fantastic way to earn passive income with the help of others. A REIT is a company that owns and operates income-generating properties. They are modeled after mutual funds, so money is pooled by multiple investors. You can even trade them publicly on the market in the same way you would a stock.

One of the benefits of investing in REITs is they are relatively low-risk. You can earn monthly dividends without assuming all the responsibility for the property. You should do your research before choosing a REIT. We recommend looking at their management strategy and track record before investing. REITs are also available for other income-generating properties such as self-storage facilities, data centers, and other commercial real estate.

House Flipping

Another great investment opportunity with 500k is to buy a house and flip it. House flipping is when an investor buys a home, makes renovations, and resells it for a profit.

There are a few different ways to flip a house. A popular option is to hire a contractor to make all of the building renovations for you. This is the most hands-off option since you can sign off on decisions without having to do the work yourself. Another popular house flipping method is to live in the home while you make renovations, which can save you money on rent. House flipping can also be quite an enjoyable experience if you are looking for a side project to work on.

Vacation Rentals

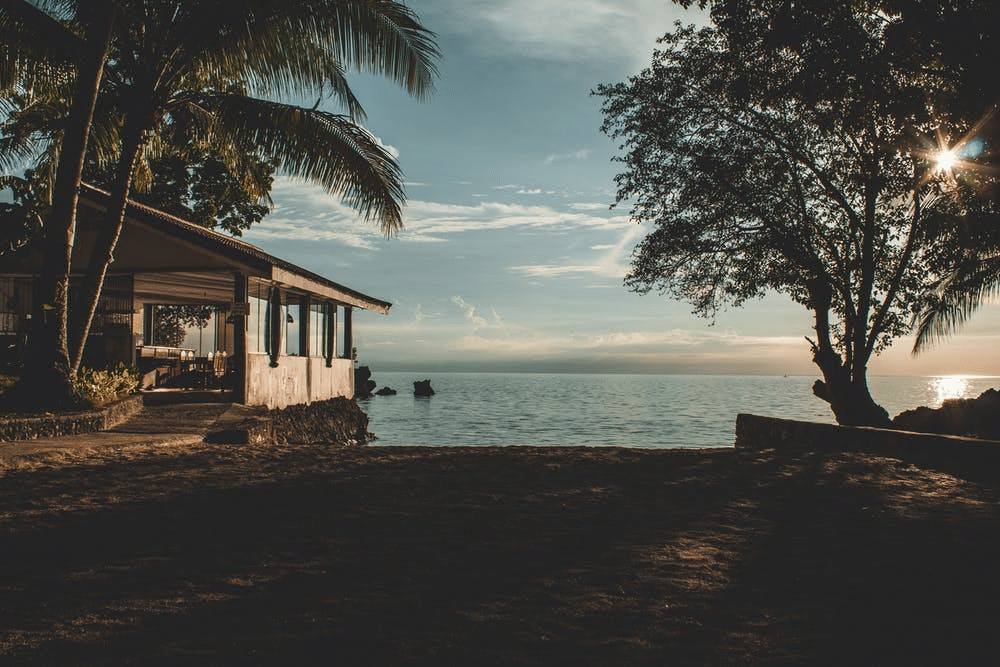

After the recent pandemic, the travel industry is poised to make an impressive recovery. Most people have not been able to go on vacation for more than a year now. Once the world opens back up again, people will be excited to be traveling again.

One of the best ways to capitalize on this opportunity is to invest in a vacation rental. While vacation homes can be more expensive to maintain and manage, the returns can be great. Vacation properties can be rented out to short-term tenants for a few days at a time. Between tenants, you can adjust the rental price according to the market. For example, weekends and holidays are more expensive than weekdays. The high season is when vacation homes make most of their money.

Another great advantage is that when you and your family want to use the home for vacation, you can black out those dates and have a place to stay whenever you want.

Residential Real Estate Investment vs Commercial Real Estate Investment

While we have discussed the best residential real estate investments, there are still many opportunities in other sectors such as commercial real estate. Before investing, you should understand some of the key differences between commercial and residential real estate. This will help you make sound decisions when looking for your next passive income investment.

Type

The main commercial real estate investment types include office buildings, retail spaces, data centers, self-storage buildings, and factories. While residential real estate includes homes and apartments.

If you have 100k or less to invest, then you may want to start in the residential sector.

Cost of Entry

One of the biggest differences between commercial and residential investments is the barriers and costs of entry. Commercial real estate costs more upfront and often requires more due diligence. With residential properties, you can make a relatively small down payment and take a mortgage out for the rest. This opens the door to people who may not have as much money to invest upfront.

Returns

Commercial property will typically bring greater returns than residential property. With more long-term tenants who don’t live on the property, maintenance and repairs are easier. Commercial buildings are typically bigger with fewer tenants, so you can maximize your returns.

Some types of commercial property are recession-proof as well. While many people may have to sell their homes during a recession, often commercial areas are booming. For example, self-storage facilities thrive in the face of economic strife. During times of economic downturn, many people may have to downsize and when unemployment is high, college students often need to move back in with their families, this can vastly increase demand for storage space.

Summary

Real estate investments are still among the most durable and lucrative investments enduring times of economic strife. In this guide, we discussed some of the best residential real estate investments you can make to ensure you reach your passive earning potential and that your money works for you. We also discussed the differences between residential and commercial real estate. If you are interested in learning more about recession-proof investments and how you can earn a passive income, check out our website.

В Україні оформити кредит онлайн без довідки про доходи простіше простого. Заповнюєте анкету на сайті МФО і очікуєте рішення.

Без дзвінків на роботу і тривалих перевірок кредит онлайн на картку з 21 року в інтернеті без відмови.

Для кожного позичальника, який бере перший займ, швидкий кредит вночі надається без відсотків і відмовних акцій.